In this issue:

- A new Zorp essay on how we think about the valuation of blockchains

- New Nockchain growth analytics

On Valuing Blockchain Protocols

There are two core drivers of economic value for L1 cryptoassets: Value Storage and Revenue Generation.

Broadly construed, Value Storage Protocols are digital gold: they aim to be credibly neutral, highly secure, long-term stores of value. Revenue Generation Protocols are akin to decentralized growth stocks: they create and capture value on a continuous basis through services that generate revenue. It is possible for L1 cryptoassets to accrue value through either or both of these means, but in most cases, protocols tend toward one or the other.

A Value Storage Protocol must be immutable and neutral, while its native asset must be credibly scarce. It avoids complexity. Its success depends on increasing distribution while minimizing governance, mutability, and risk. Value derives from trust in the ruleset. Adoption grows as uncertainty decays.

Bitcoin is a non-sovereign sound money with a hardcapped supply of 21 million coins. Bitcoin started with a fair launch, and its supply schedule has never been modified. Bitcoin functions as a Value Storage Protocol that only generates revenue via low-throughput censorship-resistant settlement. It is not programmable in the modern sense, and its advocates mostly prefer it that way. Bitcoin’s block subsidy decays geometrically, while the revenue it generates is marginal, inviting fears of a theoretical security-budget crisis. So far, Bitcoin has outperformed every other cryptoasset, with institutional capital inflows accelerating as publicly traded companies and states integrate Bitcoin into their treasury strategies.

A Revenue Generation Protocol must create and capture fees. It monetizes activity: execution, storage, settlement, and other services. Value derives from usage, not trust. Evolving user needs require active governance. The protocol must be continuously upgraded to remain a competitive service provider. The protocol surface area expands as new features are added. The asset is a bet on future growth in usage, not necessarily scarcity of the native asset.

Ethereum is the first smart-contracting platform and has developed a large ecosystem. Ethereum functions as a Revenue Generating Protocol that provides services such as on-chain smart contract execution, long-term storage of smart contract state, temporary blob storage with data availability sampling, and censorship-resistant settlement. While Ethereum is rather successful as a Revenue Generating Protocol, its native cryptoasset has not fared well as a store of value, despite concerted marketing efforts to reframe ETH as “ultrasound money.” ETH is unlikely to become a credibly neutral store of value because of its history. In contrast to Bitcoin’s fair launch, Ethereum initially issued its asset in a pre-mine. In contrast to Bitcoin’s immutability, Ethereum has been forked to revert a hack. In contrast to Bitcoin’s conservative governance, the Ethereum Foundation stewards semi-regular protocol upgrades that modify Ethereum’s core economics — at times in radical ways. Ethereum is widely considered the #2 cryptoasset, but its adoption and price performance have consistently underperformed Bitcoin’s over the past five years.

Most L1 blockchains since 2016 have emulated Ethereum’s pre-mined Proof of Stake economic model, competing as general-purpose smart-contracting protocols with the aim of generating revenue. The application layer space is now crowded with L1s, while the total number of crypto developers has not grown apace. Many private placement crypto funds have historically only been willing to underwrite investments into pre-mined coins, contributing to the dearth of novel, competitive Value Storage Protocols. However, in 2025, fifteen years after the birth of the first cryptoasset, value storage remains the most valuable crypto use case with the fastest growing market.

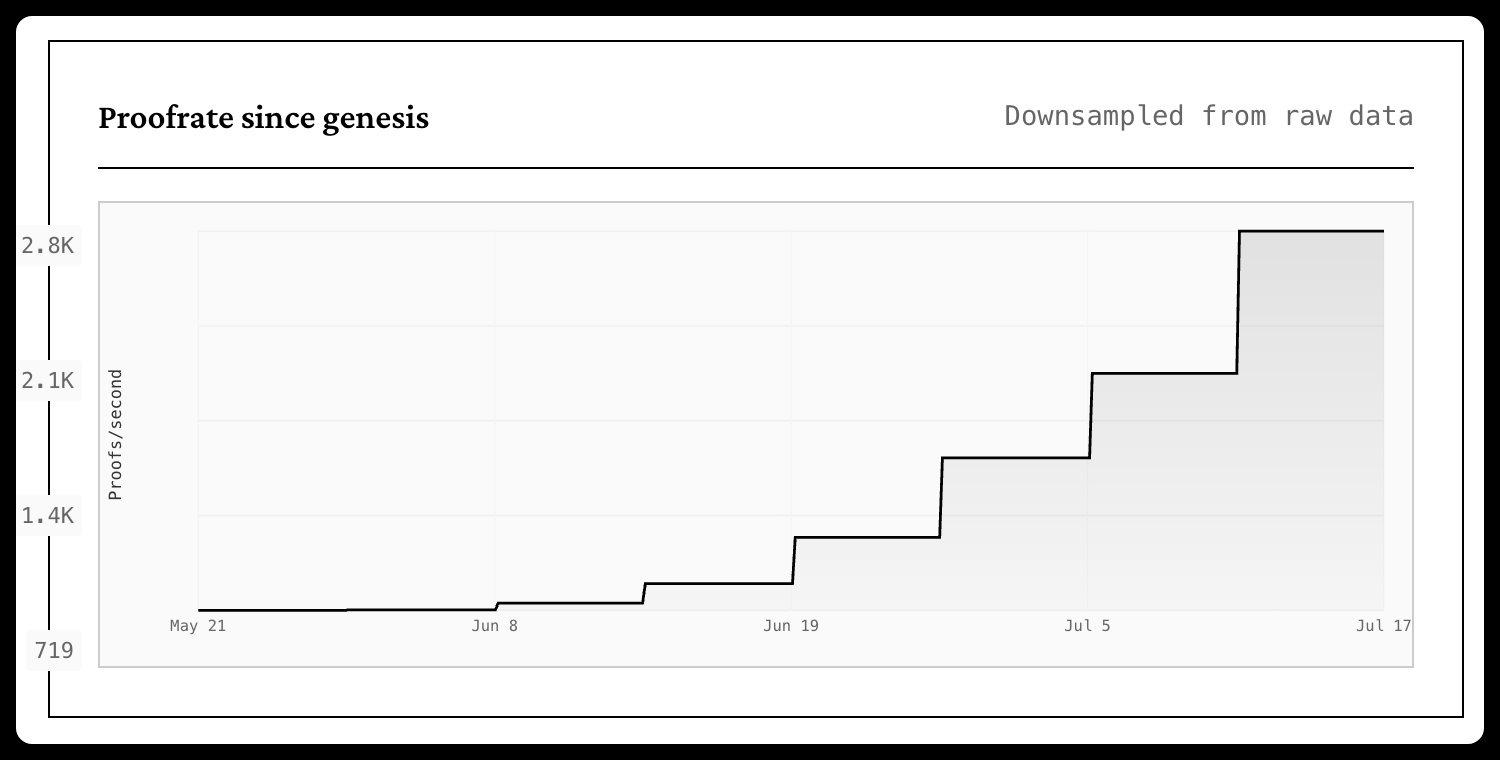

Nockchain is a novel L1 blockchain protocol launched on May 21, 2025. Nockchain’s design, economics, and history orient it as a Value Storage Protocol or digital gold. Nockchain started with no pre-mine, and its native cryptoasset (Nock) is hardcapped at 2^32 coins with an immutable supply schedule. At the outset, Nockchain is providing low-throughput censorship-resistant settlement. However, Nockchain is designed to provide high-throughput, programmability, and maximal censorship resistance over time, with a roadmap of upgrades incorporating modern research into scalability, programmability, data-availability, and Zero-Knowledge Proofs. These capabilities position Nockchain competitively for generating revenue, negating the risk associated with Bitcoin’s reduction in security-budget over time. History has shown that Revenue Generating Protocols struggle to become neutral stores of value, but history has yet no verdict on whether Value Storage Protocols can add revenue generation. Nockchain is the only Value Storage Protocol with a conscious strategy to add revenue-generating features over time.

This article is not investment advice. Zorp does not issue $NOCK, does not create a market in $NOCK or guarantee that any such market will be made.

Nockchain Analytics Update

Using Nockchain data provided by NockBlocks, here's a snapshot since our last newsletter.

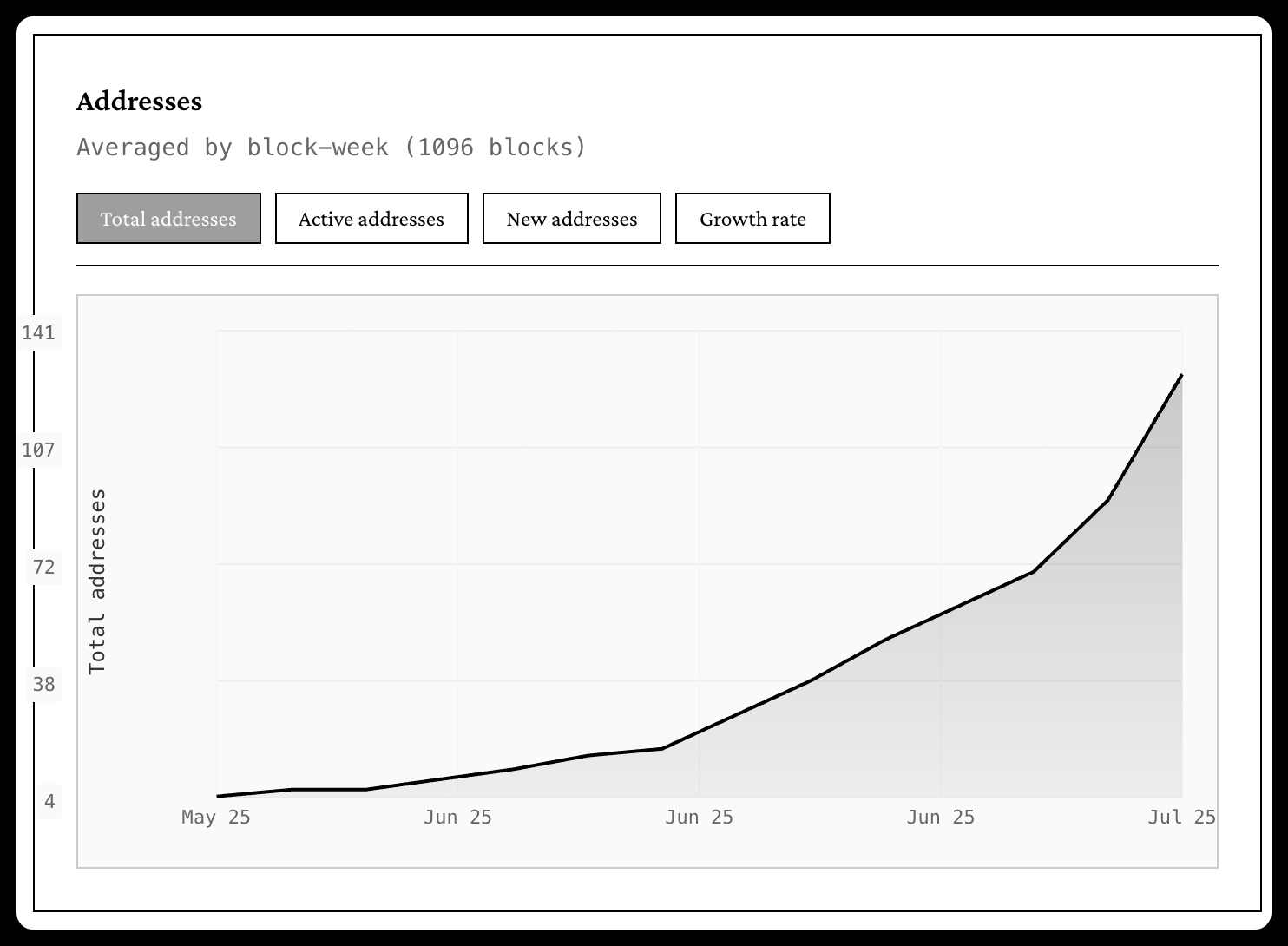

In the past 7 days:

- New active addresses: 58

- Total volume transacted: 74M $NOCK

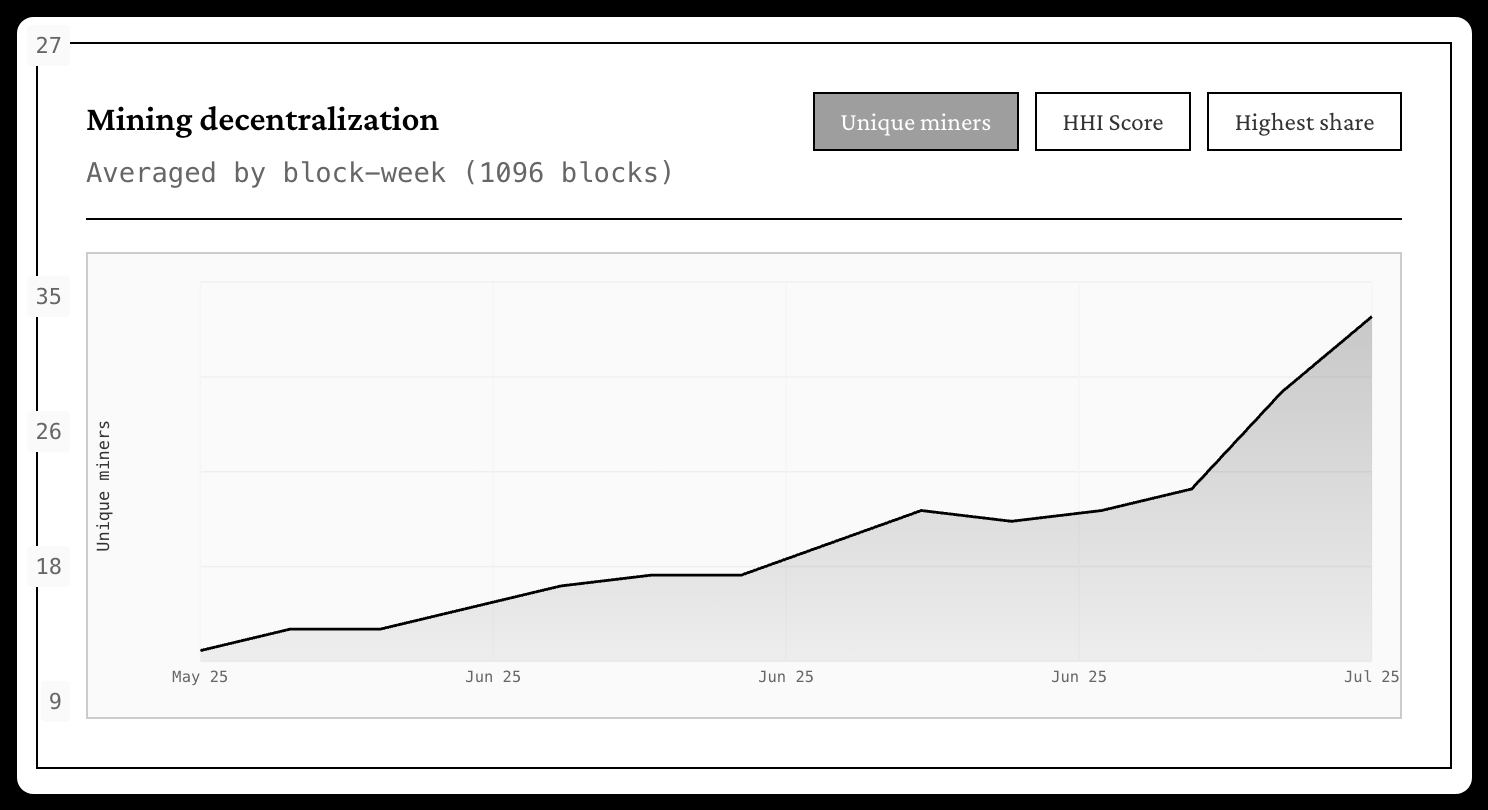

- New miners who won their first block: 35

All-time:

- Addresses with at least one transaction: 137

- Miners who've won at least one block: 67

That's all for this week.

Thanks for reading!